Article

200 Students Experience Budgeting Simulation

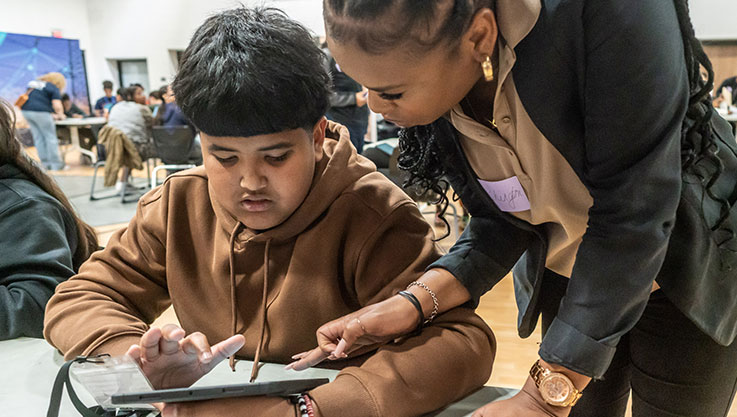

“Why do taxes come out of my paycheck?” “Groceries are so expensive!” These were a few of the common responses to a budgeting simulation with middle school students at Village Tech Schools in Duncanville, Texas. The two-day event, presented by Elan Credit Card (Elan) and the African-American Credit Union Coalition (AACUC), hosted 100 sixth graders and 100 seventh graders to work through the Junior Achievement of Dallas JA Finance Park simulation.

Elan and AACUC were joined by volunteers from AACUC Texas Regional Chapter member credit unions Resource One Credit Union, Randolph-Brooks Federal Credit Union, Neighborhood Credit Union, and Baylor Health Care System Credit Union to guide students through the budgeting model in conjunction with national financial literacy month.

“Financial well-being is a core tenet of the credit union movement,” said Delana Huling, President/CEO of Baylor Health Care System Credit Union and AACUC Texas Regional Chapter President. “Historically, communities of color have had many reasons to mistrust financial institutions, so being able to empower our youth with financial education in an immersive experience like this can have lasting, positive financial outcomes while also making banking and financial services more inclusive for them.”

The digital experience gave each student a profile including job, income, and family. Once the student understood their net monthly income, they created a budget for various expense categories like housing, clothing, food, electricity and wants such as concert tickets and vacations.

After their budget was confirmed, students were able to put their budget to practical use through a shopping exercise. As each student made decisions on buying name-brand clothes versus generic, or a bus pass versus concert tickets, each learned about the importance of budgeting, wants versus needs, impacts of financial decisions, and why learning these skills is important to financial wellness.

Elan Payment Solutions Consultant, Stephen Nance shared, “One student in my group insisted they wanted a luxury vehicle. After discussing that buying an expensive luxury item would mean less money in the budget for other essential responsibilities such as mortgage, utility bills, and groceries — the student quickly reconsidered a more affordable vehicle. It was rewarding to see those lightbulb moments for each student at different phases of the simulation.”

In addition to the two-day experience, Elan donated $15,000 to Village Tech Schools to extend the reach of these learning opportunities for their students.

“We recognize the need for classes and experiences like JA Finance Park in schools across the country. That’s why we sponsored this event, and why we donated an additional $15,000 to Village Tech Schools to ensure more of their students can experience similar opportunities,” said Matt Good, Elan SVP & Director – Regional Partnerships.

While JA Finance Park is an established program for Junior Achievement of Dallas, the pandemic compelled the organization to reimagine delivering the program in a different setting.

“Partnering with Elan and AACUC was invaluable and truly helped us refine the program to meet the evolving needs of students and school administrators in a post-pandemic learning environment,” said Keshia Bruno, Vice President of Educational Impact for Junior Achievement of Dallas. “We’re grateful for the time, talent, and treasure each organization contributed to organize and execute the event to ensure such a phenomenal experience for the students.”

To learn more about this event and the Elan Charitable Giving program visit elancharitablegiving.com.

ARTICLE

5 Questions for Financial Institution Leaders

Five questions leaders should ask to decide what credit card model is best for their financial institution and customers.

ARTICLE

Is It Time to Re-evaluate Your Credit Card Program?

Is your card program meeting customer needs and still earning income? Explore three steps to evaluate your credit card program.

Start a conversation

If you are interested in learning how Elan can help build your credit card program, we'd love to hear from you.